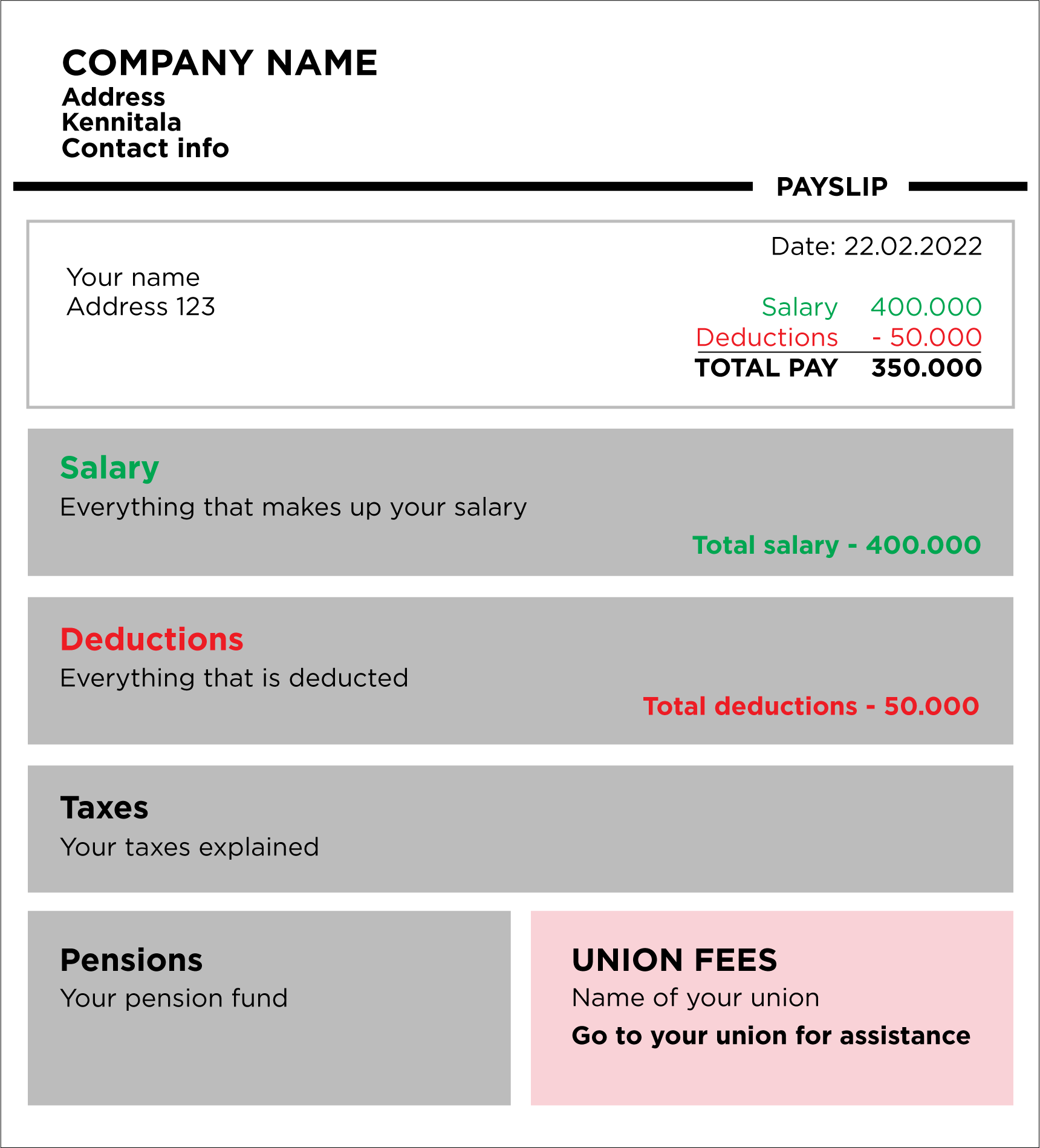

The payslip

You have a right to get a payslip along with your salary.

Your payslip must show all wage items that make up your salary, as well as everything that the employer deducts from your salary, such as taxes, pension contributions, union membership dues, and so on.

The employer is responsible for transferring all these payments to the appropriate places. What remains is the salary you get paid into your bank account. The payslip should also show which union you are member of.

You can usually find your payslip in your

online bank, under electronic documents

Salary

Your payslip must show all wage items that make up your salary, like daytime hours, overtime hours, December bonus, etc.

Deductions

The payslip should also show everything that the employer deducts from your salary, such as taxes, pension contributions, union membership dues, and so on. The employer is responsible for transferring all these payments to the appropriate places. What remains is the salary you get paid into your bank account.

Taxes

Employers are required to deduct income tax from the worker’s wages every month and return to the tax office. Everyone has a right to a personal tax credit (tax discount). You must inform the employer that you want to use your tax credit, otherwise the employer might deduct the whole tax from your wages.

Pensions

All workers between the ages of 16 and 70 are required by law to be members of a pension fund. Pension funds pay old-age pensions, disability pensions and pension payments to surviving spouses and/or children.

You can also decide to pay extra pension fees (I. viðbótarlífeyrissparnaður), that are private and non-obligatory, and then your employer must pay 2% of your wages into a special fund.

Union fees

The payslip should show which union you are member of.

If you are unsure whether you got the correct salary, go to your union and have them go over the payslip with you